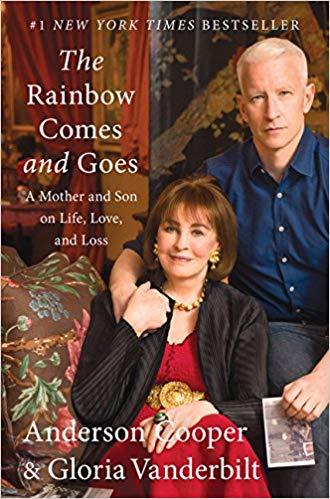

The Gloria Vanderbilt Estate Plan along with her 2016 memoir co-authored with her son Anderson Cooper, offers some insights into both parenting and estate planning.

Vanderbilt’s wealth has been estimated at $200 million and we know that she has three surviving sons, one from whom she was estranged. A will was used for at least part of the estate planning. That document must be filed with a court to be probated, which is a public process. So, the public has a window into the life she led and those that she leaves behind.

Public Probate of the Vanderbilt Estate Plan

We know from her publicly filed will that Anderson Cooper appears likely to inherit the majority of the probate estate of about $1.5 million. This does not account for the estimated $200 million estate which leads observers to believe that Ms. Vanderbilt utilized trusts, beneficiary accounts, and life insurance to avoid the public court process at least in part.

That public process of probate also gives us access to Ms. Vanderbilt’s ancestor’s estates, and her inheritance at the age of 2 along with the ensuing custody battle between her mother and her aunt.

Parenting for Individual Success

It was important to Ms. Vanderbilt that her children not rely upon her wealth, but that they seek out their own success. Anderson Cooper revealed in an interview with Howard Stern that he had been told by his mom that there would be no trust fund for him and that this pushed him to achieve success.

Successful Estate Planning

There are lessons to be learned from Ms. Vanderbilt, her life and how she parented and planned her estate. Our planning techniques strive to keep our clients and their families out of conflict and out of court.

Probating a $1.5 million estate is an expensive proposition in California with statutory fees of approximately $65,000 along with many other costs. Properly placing those assets into a living trust would avoid that expense and would spare your heirs the public exposure.

The publicity is also an opportunity for the unscrupulous to exploit your loved ones as they will know through the publicly filed documents what they are to inherit. A foundational estate plan prepared by our office can help you avoid this at a small fraction of the cost likely to be incurred in California’s probate courts.